Are Home Office Expenses Deductible In 2025 - Self Employed Home Office Deduction 2025 Debra Eugenie, In this article we explain the details of the new rules, who is eligible for the deductions, what types of expenses are deductible and how to correctly record them on your. Home Office Expense Deduction 2025 Layla Anastasie, Property taxes are also deductible (up to $10,000 annually), and you may be able to write off expenses like home office costs — as long as you use your home office specifically.

Self Employed Home Office Deduction 2025 Debra Eugenie, In this article we explain the details of the new rules, who is eligible for the deductions, what types of expenses are deductible and how to correctly record them on your.

Our calculator takes between 5 and 20 minutes to use. Home office equipment, including computers, printers and telephones.

Business Use Of Home Deduction 2025 Fayre Jenilee, Have records to prove your.

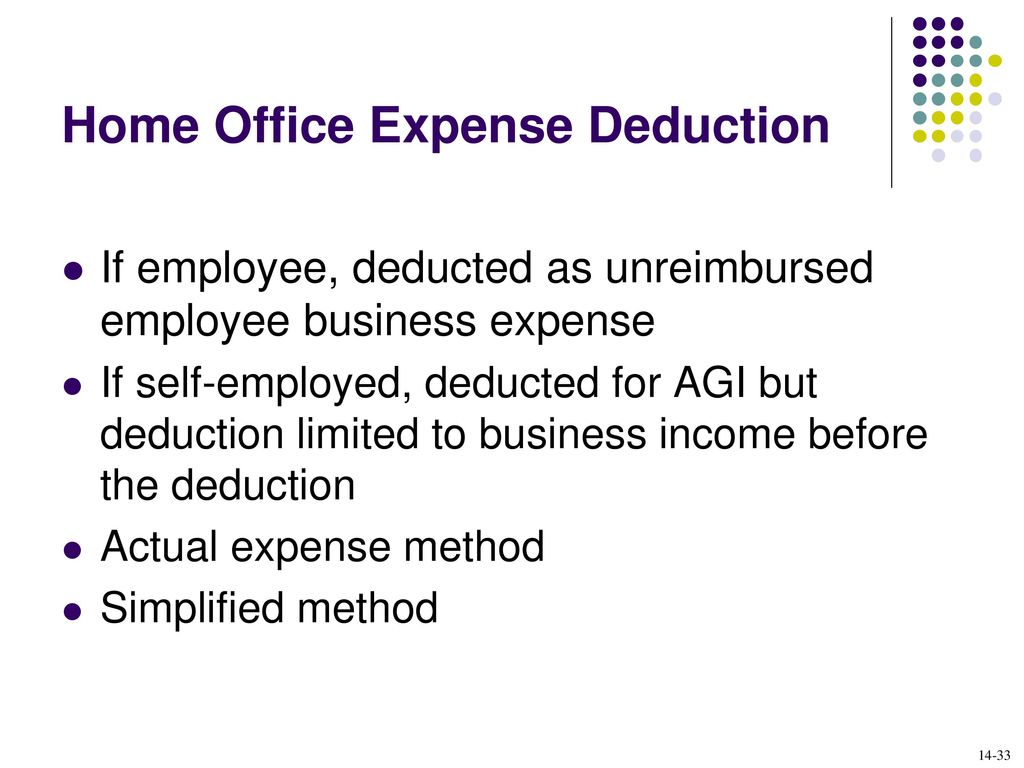

Tax Consequences of Home Ownership ppt download, What is the fixed rate for tax time 2025?

25 Small Business Tax Deductions To Know In 2023, If you are claiming your working from home expenses, you can’t claim a deduction for expenses which have already been reimbursed by your employer.

The Home Office Expenses Deduction Guide for Employee, Can i claim a deduction for working from home expenses?

Home Office Expense Deduction 2025 Layla Anastasie, This covers a range of essentials.

Kia Niro Review 2025. See our expert review on the…

Monmouth Park 2025 Schedule. For beginners, it’s best to start…

How are home office expenses deductible for your business?, As an employee, you can deduct the additional running costs and.

What Are Expenses for Home Office? Find Out Here!, Generally, a taxpayer is not able to claim deductions for expenses associated with their home because these are private or domestic in nature and disallowed under subsection 8.